26+ paycheck calculator idaho

Are You Withholding Too Much in Taxes Each Paycheck. Get 3 Months Free Payroll.

Idaho Hourly Paycheck Calculator Gusto

Idaho follows the federal Fair Labor Standards Act when it comes to overtime.

. The drop down displays twelve future pay dates to choose from. No state-level payroll tax. Well do the math for youall you need.

Supports hourly salary income and multiple pay frequencies. This free easy to use payroll calculator will calculate your take home pay. Ad The Form W-4 or IRS Tax Withholding Form Determines Your Net Paycheck and Tax Refund.

Web Launch ADPs Idaho Paycheck Calculator to estimate your or your employees net pay. This means that most hourly employees. 12 per year while some are paid twice a month on set dates 24.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Enter your period or annual income together with the necessary federal state and local W4 information into our free online payroll calculator. All Services Backed by Tax Guarantee.

Free for personal use. Ad Fast Easy Affordable Small Business Payroll By ADP. Do residents of Idaho pay personal income tax.

Get Started with up to 6 Months Free. All-In-One Payroll Solutions Designed To Help Your Company Grow. The pay rate can be entered as whole.

Afraid You Might Owe Taxes Later. The income tax rate ranges from 1125 to 6925. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Web As an employer youre responsible for paying SUI remember if you pay your state SUI in full and on time you get a 90 tax credit on FUTA. Web The median household income is 52225 2017. Get Your Quote Today with SurePayroll.

Employees rate of pay. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web The Idaho paycheck calculator will calculate the amount of taxes taken out of your paycheck.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Web The state income tax rate in Idaho is progressive and ranges from 1 to 6 while federal income tax rates range from 10 to 37 depending on your income. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Idaho.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web Use our income tax calculator to find out what your take home pay will be in Idaho for the tax year. Web The minimum wage in Idaho is 725 per hour.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Web Paycheck Calculator Idaho - ID. Idahos SUI rates range.

ADP hires in over 26 countries around the world for a variety of. Make The Switch To ADP. Web Displays the next pay date by default.

For example if an. Web How to calculate annual income. Enter your details to estimate your salary after tax.

Yes if you are a resident of. Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Idaho Paycheck Calculator Smartasset

77 Golden Eagle Dr Boise Id 83716 Realtor Com

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Salary Paycheck Calculator Calculate Net Income Adp

Towards Jlamp A A Next Generation Photon Jefferson Lab

Us Paycheck Calculator Queryaide

Fixation Base Roe Dental Laboratory

Barney Labrador Welpen Tasse Tasse Matt Barneysshop

Which Volume Of Stone Base Sub Base Per Mile Its Used When Paving A Typical Route Highway Quora

How Much Does City Electrical Factors Pay In 2023 244 Salaries Glassdoor

Idaho Paycheck Calculator 2022 2023

Paycheck Calculator Us Apps On Google Play

How Much Is A Speeding Ticket In California Other States

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

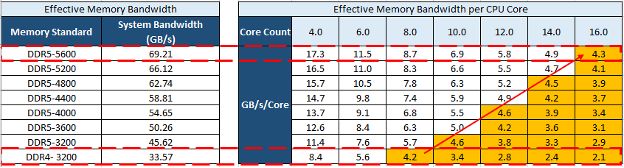

Ddr5 Memory Everything You Need To Know Crucial Uk

How To Pay Tipped Employees In A Restaurant Qwick

New Tax Law Take Home Pay Calculator For 75 000 Salary